Imagine a world where your bank functions more than just a bank.

Let’s say you’re heading to the bank to borrow a car loan. You enter the doors only to be greeted by a café. You grab a cup of coffee, maybe even unwind with some group yoga, and finally, you sit down with your financial advisor to discuss the business you had set out to do.

Sound like something out of a movie?

Well, this is the reality promised to us by a Phygital approach to banking- a hybrid of the digital and physical aspects of traditional services- with the retail experience taking place in both.

This approach combines the comfort of a brick-and-mortar bank and human workforce with the advantages of technological advancements (like Artificial Intelligence, Internet of Things, Machine Learning, Distributed Ledger Technology) to serve customers better.

An Accenture report showed that Phygital experiences generate twice as much revenue as traditional single-channel operations, 30% more cross-selling, and a third less churn.

Impact of the Pandemic

The COVID-19 pandemic accelerated all the digitalization initiatives we’re seeing around us today.

Yes, it’s true that the 2008 recession caused the initial boost in experimentation, innovation and welcomed a wave of financial technology (FinTech) start-ups. But, this time the onus is more on delivering a genuine change.

Under strict lockdown restrictions, digital became the overnight primary channel for businesses like retail, healthcare, real estate, auto, etc. The banking industry wasn’t far behind.

Noteworthy Examples of Phygital Banking

- Capital One Bank converted its branches into trendy cafes where patrons can bank, plan their financial journey over coffee with coaches, or simply enjoy their fully equipped co-working space.

Also available are interactive screens and “Demo Bars” providing educational content about finance.

- Umpqua Bank changed the branding of their branches to “stores” – where they host community events like yoga classes and movie nights for kids. The stores quickly turned into hubs, where patrons can come together to browse, shop, enjoy free Wi-Fi or sit and read.

Some Promising Trends Closer to Home

According to a FIS Global PACE Report:

- 68% of Indian consumers are using online or mobile banking to conduct financial transactions.

- 48% of respondents expect to continue using contactless payments instead of cash or card in the post-COVID-19 world.

Advantages of Phygital Banking

One of the biggest advantages of Phygital is that it still allows for physical visits to a bank for the section of people who’re unable to keep up with rapid digitization.

Thus, banks can assure them with trust and comfort, eventually leading to customer satisfaction.

Some more benefits are:

1) Increased Customer Value and Cost Reduction

By automating repetitive backend and frontend tasks and reducing the processing time for paperwork, phygital banking negates the need to employ a large workforce or invest in expensive real estate.

Instead, they can hire a small yet highly skilled set of employees to work directly with patrons, and lease a smaller space.

2) Improved Customer Experiences through Omnichannel

Phygital setups are the most viable solution for patrons who wish to seamlessly change their choice of engagement touchpoints.

They have the option to either use their smartphones, tablets, kiosks, digital walls, or touch-tables installed in the branch to gain product knowledge, or they can simply talk to one of the trained bank staff to discuss their doubts directly.

3) Anticipating Valuable Customer Needs

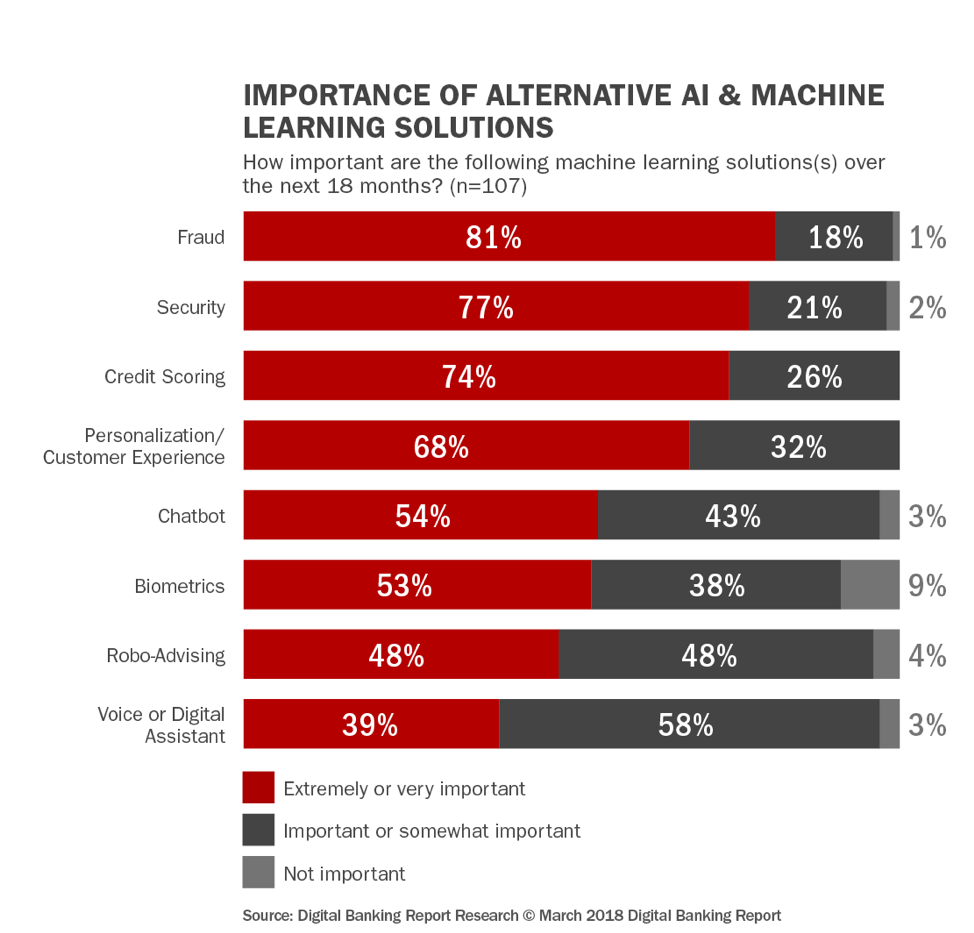

Innovative technologies such as AI, ML, and data analytics segregate a patron’s individualized data on a secure database.

This provides keen insights and enables phygital banks to anticipate what that customer might need in the future and deliver personalized products and services directly to them.

4) Securing a Wider Market Share

The world is at a juncture where there are discussions surrounding open banking regulations to help banks become more transparent and secure (regarding data).

Phygital banking can build a connected ecosystem and work as a facilitator between the urban and the rural, where digital is still not widely accepted.

5) Improved Relationships between Banks and Customers

Phygital ensures the existence and availability of branches while leveraging FinTech solutions and self-service platforms at every touchpoint, building trust and making the entire banking journey hassle-free and satisfactory for patrons.

Now that you’re aware of the many advantages, let’s look into three simple steps to get you started on designing a better Phygital experience for your customers:

Step 1: Get to know your target audience

Start with your customer’s pain points by examining data from dissatisfied customers.

What problems did they face, and how can you solve them using a phygital marketing strategy?

Then, we recommend creating a detailed customer journey map and decide how to make your products more discoverable.

Leveraging technologies like the Internet of Things and AI can help you collect the data to extract valuable insights and make smarter decisions.

Step 2: Include them in the process

Customers want to be an integral part of the innovation process to connect with your brand emotionally.

They want to know their opinions made a real impact. So, make sure to include user-generated content to improve your products and offerings. Doing this assures your customers that you really care about their opinions and experiences as a brand.

For example, Santander Bank released a warm and engaging campaign video that included actual footage sent in by their customers, to convey the bank’s commitment to helping people prosper.

The result? The campaign delivered impressive Ad Recall and reached the top 25% of Brand Lift Surveys.

Step 3: Invite community-driven solutions

By marketing across multiple channels like social networks, digital, print, and radio, your brand gains the ability to create diverse communities around your products and services.

These active communities can then be tapped to explore new opportunities for your brand’s influence to share knowledge, cross-sell, and gain more loyal customers.

Global leader JP Morgan Chase recently announced their AdvancingCities Challenge, offering five winning cities $3 million each to help scale efforts addressing persistent problems facing their local communities today.

How we can help

In today’s competitive world, you’ll want to make the best first impression of your bank with prospective customers.

The first step you can take is to create dynamic campaigns across digital media channels for better reach, engagement, and improved ROI.

Hindustan Times Media’s Digital news properties can help you make this lasting connection with your audience, wherever they are. Our websites including hindustantimes.com, livehindustan.com, and livemint.com bring in more than 139 million unique visitors every month. To know more about partnering with us, click here.

Ready to take your brand to the next level? Connect with us today to explore how HT Media can amplify your presence across our diverse portfolio of 25+ brands and properties. Let's turn your brand vision into reality!

Comment