Did you ever think that someday you could take financial advice about how and where to invest your hard-earned money from a “robot”, in just a few clicks?

Well, the pandemic has intensified the importance of digital transformation systems in wealth management.

Technology-driven wealth management startups are increasingly offering clients digitized and long-term financial planning through software products called “Robo-Advisors”.

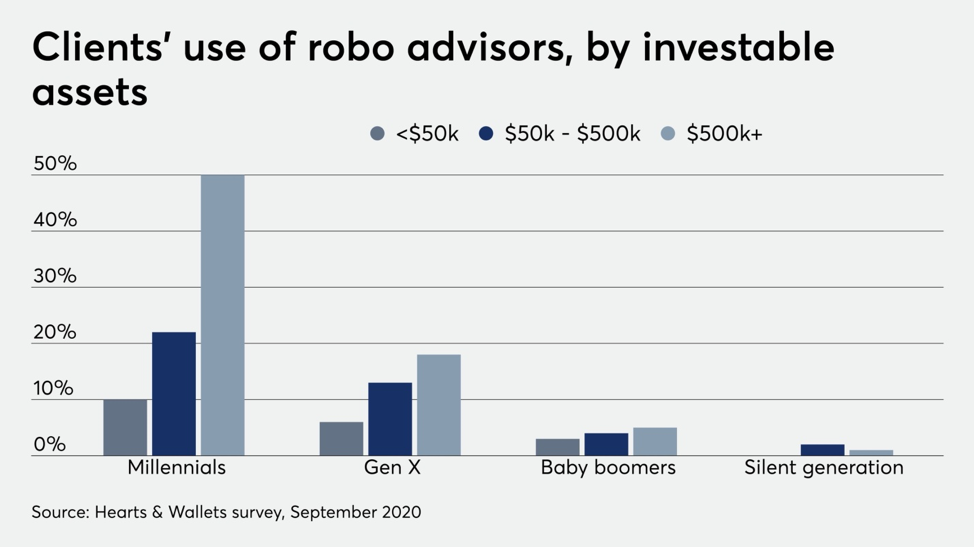

Following this trend, many investors, especially from the millennial generation, are gravitating towards technology platforms in their wealth management strategies.

In particular, Asia-Pacific is expected to witness the highest CAGR of 34.8%, because of key software players in the market establishing their presence in emerging countries. like China and India.

New vs. Older Generation

When it comes to technology, there is a stark difference between the attitudes of the younger and older generations.

Capgemini’s ‘World Wealth Report’ found that most younger High Net Worth Individuals (HNWI) were willing to transfer their wealth via an automated advisor.

However, a Forbes report revealed that investors over 50 cared more about data security and weren’t as comfortable with virtual communications in their wealth management.

Business Insider had predicted that Robo-Advisors will account for $4.6 trillion in assets under management by 2022.

4 Benefits of Robo-Advisors

To better foster the relationship between wealth management firms and their clients and thrive in the developing post-pandemic environment, it’s essential for these firms to invest in technological tools, platforms and expertise.

As the application of artificial intelligence (AI) in developing Robo-Advisors increases, financial advisors can look forward to reaping the following benefits:

1) Digital Competitive Edge

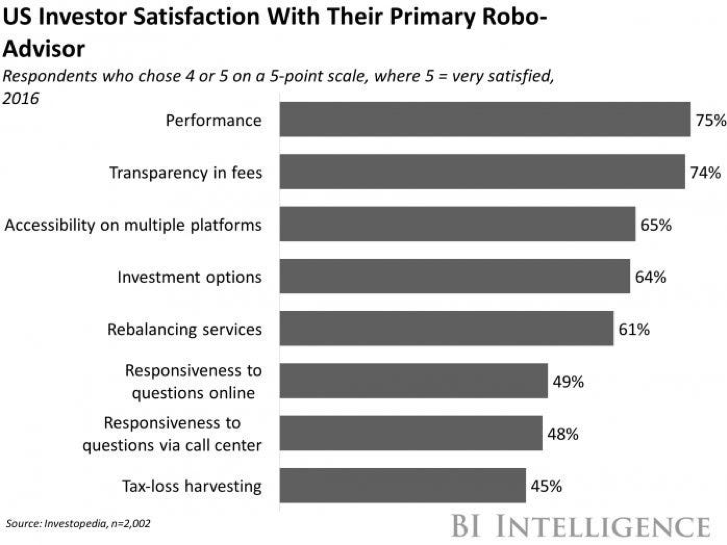

Robo-advisors add value and convenience for clients by allowing them to invest in different asset classes through mobile phone applications. They also provide clients with full access to multiple portfolio management tools, which offer more flexibility and security.

Some clients are prone to switch their wealth management providers. The availability of such accessible and tech-savvy solutions as Robo-Advisors will ensure a competitive advantage for the firm providing it. This will strengthen customer retention and assist in effortlessly onboarding new customers, too.

Nowadays, accessibility and ease of use are the top priorities for any type of service. By utilizing Robo-Advisors, clients can access their investment portfolio 24/7 with the click of a button.

2) Profile Accuracy and Fraud Mitigation

The chances of error or deviation with machine learning and cloud-based applications like Robo-Advisors are notably less.

Thanks to machine learning, client data can be easily collected and monitored to create instant alerts and reduce fraudulent activity.

For example, if any irregular activity is detected on the client’s mobile device, fraud systems can accurately investigate where that transaction went wrong.

Perhaps the greatest benefit of this is the reduction of human error or the need for any manual input.

3) Enhanced Portfolios

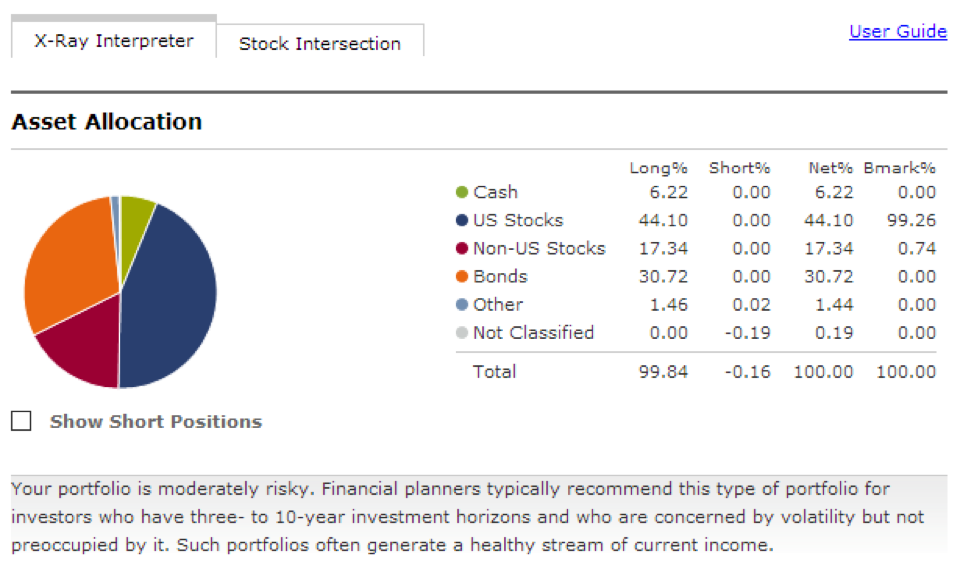

Robo-advisors employ mathematical algorithms that select the optimum investment portfolio option for your client, based on their goals and current financial situation. This creates a safer or more strategic portfolio option for that client.

It may be true that when it comes to investment opportunities, face-to-face contact is preferable. But AI does the groundwork for clients to lay out all the various facts and considerations before they can make a concrete decision.

The double advantage of this is that it contributes to successfully gaining your client’s trust and also increases the accuracy of their asset investments.

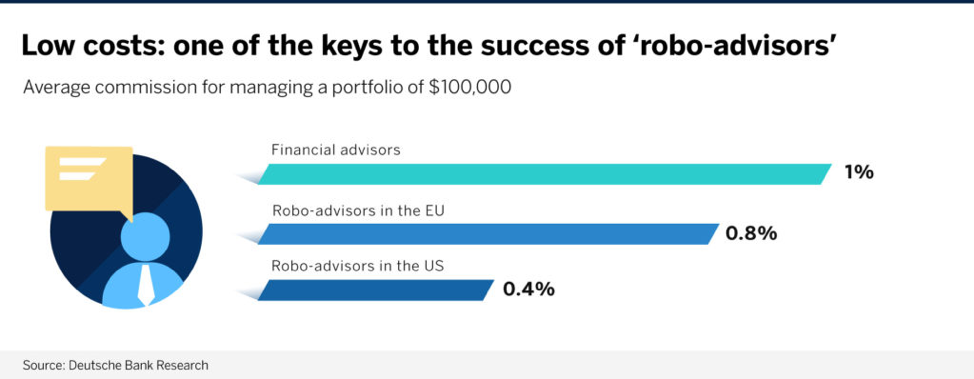

4) Lower Costs

From the client’s perspective, the biggest advantage of utilizing Robo-Advisors is that it provides a low-cost alternative to traditional investing.

Because of the elimination of human labour, lower overheads and little-to-no minimum investments required, the rates and fees for Robo-Advisors are significantly reduced.

According to Investopedia, financial planners usually charge a 1-2% rate, potentially adding more as a commission-based fee.

In contrast, using Robo-Advisors typically ends up affecting the client’s ROI by only 0.2%-0.5%.

We strongly recommend that as a wealth management firm in pandemic times, you consider how to best implement Robo-Advisor services and embrace the new opportunities and benefits they bring.

Yes, there will always be investors who prefer human interactions. However, developing a robust hybrid model that provides both Robo-Advisors and a human touch will help you thrive in this competitive market.

We Can Help You Find Potential Investors

Take the first step towards leveraging the power of your newly acquired Robo-Advisor platform by grabbing the eyeballs of both your existing clientele and potential new investors.

Wondering how to maximize your reach?

Create dynamic digital advertising campaigns with HT Media. Together, our news properties hindustantimes.com, livehindustan.com and livemint.com enjoy a reach of over 139 million. To learn more about what we can offer your brand, visit here.

Ready to take your brand to the next level? Connect with us today to explore how HT Media can amplify your presence across our diverse portfolio of 25+ brands and properties. Let's turn your brand vision into reality!

Comment