Theme 2023: Resilience & Growth

How mutual funds can adapt to bull, bear & sideways markets

Mint Mutual Fund Conclave 2023

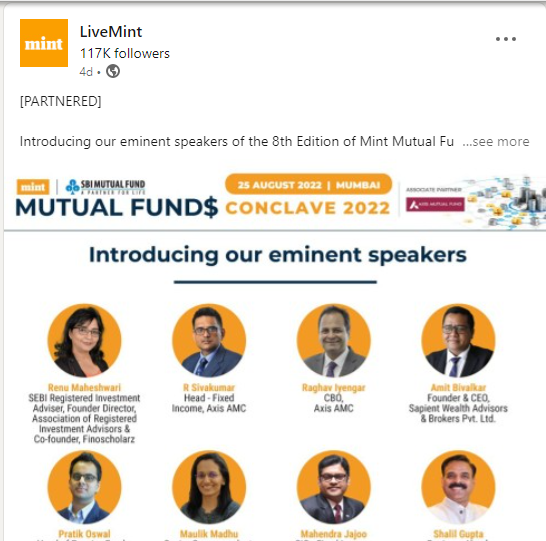

The Conclave provides multiple touch points at the event, pre & post event buzz through print & social media for high brand visibility.

Agenda

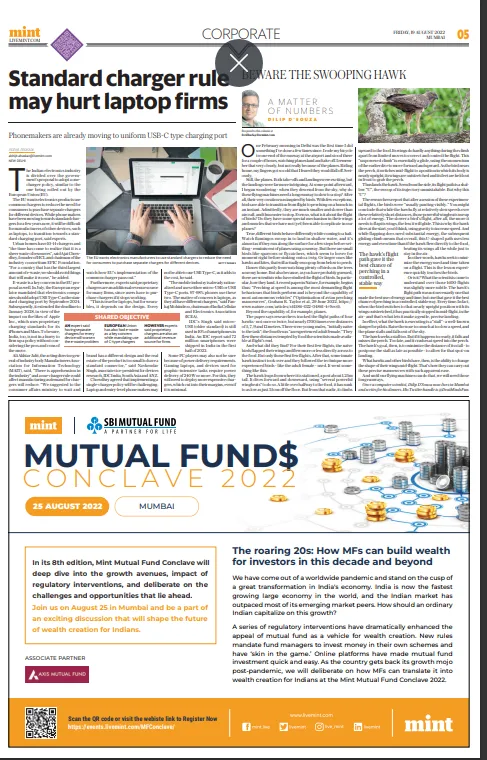

The next 40 trillion: How Mutual Funds can build wealth for India's growing investor base 2023 marks a year of maturity for India's 44 trillion-rupee Mutual Funds industry. Mutual Funds have grown their share in the financial portfolios of India's households. However, there is still a long way to go and new challenges to confront such as the removal of tax benefits and reduction of expense ratios. Mint Mutual Fund Conclave 2023 will focus on how the industry can position itself for the next growth phase and deal with its challenges.

3:30 PM onwards

3:30 – 4:30 PM

Registration

4:25 – 4:30 PM

Welcome Address

By Neil Borate, Deputy Editor, Mint

4:30 – 4:50 PM

Keynote Address

By Ananth Narayan, Whole Time Member, SEBI

4:50 – 5:30 PM

Panel Discussion

Debt Fund Tax- What solutions does the MF industry have? This panel will discuss the impact of the tax on debt funds, their possible substitution by hybrid funds and new structures that the industry can launch.

Panelists:

Sandeep Jethwani, Co-Founder, Dezerv

Neil Parikh, CEO, PPFAS Mutual Fund

Aashish Sommaiyaa, CEO, WhiteOak Capital Asset Management Ltd

Vinita Jain, Director, Pay It Forward

Moderator:

Neil Borate, Deputy Editor, Mint

5:30 – 5:45 PM

Podium Address

By Ashish Gupta, Chief Investment Officer, Axis Mutual Fund

5:45 – 6:00 PM

Tea Break

6:00 – 6:15 PM

Podium Address

By Swarup Mohanty, CEO & Director, Mirae Asset Investment Managers (India) Pvt. Ltd.

6:15 – 7:00 PM

Panel Discussion

AA and AI - What's the next wave of innovation in Mutual Funds? The panel will discuss emerging areas of innovation in mutual fund investing such as the account aggregator system, artificial intelligence and the use of machine learning in both investing and customer service.

Panelists:

Varun Sridhar, CEO, Paytm Money,

Dr. Chetan Mehra, Head - Quantitative Investments PMS & Alternative Investments, Bandhan AMC Limited

Vetri Subramaniam, Chief Investment Officer, UTI Asset Management Company Ltd

Moderator:

Sashind Ningthoukhongjam, Correspondent, Mint

7:00 – 7:45 PM

Panel Discussion

Expense Ratios, Performance Fees in the Mutual Funds industry This panel will discuss the impact of Sebi's consultation paper on total expense ratio and performance-based fees, what it would mean for industry and investors.

Panelists:

Radhika Gupta, MD & CEO, Edelweiss AMC

Sandeep Tandon, CEO & Director, Quant Mutual Fund

Avinash Satwalekar, President, Franklin Templeton India

Suresh Soni, CEO, Baroda BNP Paribas Asset Management India Pvt. Ltd

Moderator:

Jash Kriplani, Senior Assistant Editor, Mint

7:45 – 7:50 PM

Closing Remarks

By Alokesh Bhattacharyya, Deputy Managing Editor, Mint

7:50 PM onwards

Dinner & Cocktails

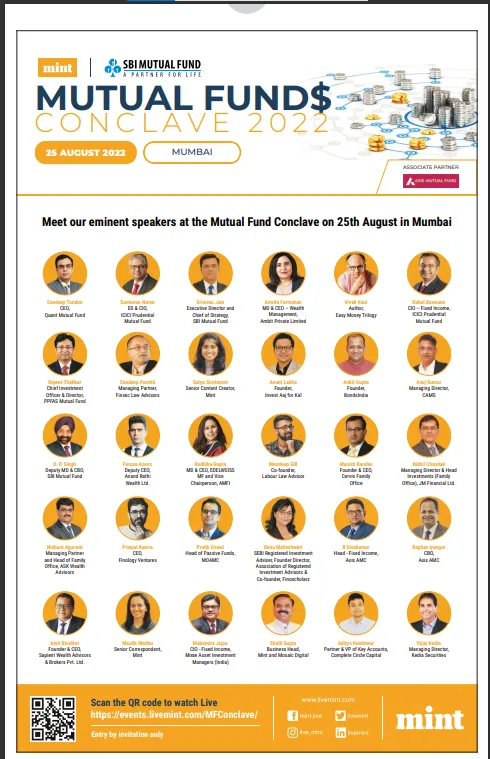

Our Panelists

Ananth Narayan

Whole Time Member, SEBI

Radhika Gupta

MD & CEO, Edelweiss AMC

Sandeep Tandon

CEO & Director, Quant Mutual Fund

Neil Parikh

CEO, PPFAS Mutual Fund

Swarup Mohanty

CEO & Director, Mirae Asset Investment Managers (India) Pvt. Ltd.

Aashish Sommaiyaa

CEO, WhiteOak Capital Asset Management Ltd

Ashish Gupta

Chief Investment Officer, Axis Mutual Fund

Sandeep Jethwani

Co-Founder, Dezerv

Dr. Chetan Mehra

Head - Quantitative Investments PMS & Alternative Investments, Bandhan AMC Ltd

Vetri Subramaniam

CIO, UTI Asset Management Company Ltd

Suresh Soni

CEO, Baroda BNP Paribas Asset Management India Pvt. Ltd

Avinash Satwalekar

President, Franklin Templeton India

Varun Sridhar

CEO, Paytm Money

Vinita Jain

Director, Pay It Forward

Why You Should Attend

Latest Trends & Future of Mutual Funds

Stay up-to-date with the latest trends & learn about the future of mutual funds

Networking

Opportunities

Networking with like-minded people & learn from their experiences.

India's

Financial

System

Contribute to the strengthening of India's financial system.

Our Partners

Fantastic On-Ground Branding Opportunities at the Venue

Reach your target audience using Mint's unparalleled influence

Mint, one of India's leading business newspapers, establishes its unrivaled dominance through its extensive reach & influential position, serving a distinguished readership and solidifying its reputation as a trusted beacon of authority in the field of business journalism, through print media, email marketing and run-on-site display banner ads on the Mint website.

-

4 Mn

Social Media Reach

-

650 K

Reach through print news

-

51%

From NCCS A1 Premium Readership Profile

-

72%

Exclusive readers for Mint