A High-Impact Brand Experience at India’s Premier Investment Platform

Mint India Investment Summit & Awards 2026

Where brands take centre stage before India’s most powerful investment and business audiences.From on-ground visibility to cross-platform amplification, the summit is built to deliver impact, recall and influence for partners.

Mark the Dates for India’s Most Influential Investment & Brand Platform

March 11 & 12

March 11 & 12 Taj Lands End, Mumbai

Taj Lands End, Mumbai

- Days

- Hours

- Minutes

- Seconds

Introduction & Agenda

As global trade dynamics reset and tariff regimes evolve, India is emerging as a key destination for capital, manufacturing and long-term investment. Structural reforms, resilient markets and strong domestic demand continue to underpin the country’s growth story amid global uncertainty.

Against this backdrop, the Mint India Investment Summit 2026 brings together investors, policymakers, business leaders and founders to examine how investments are being reimagined in a post-tariff world, from shifting global capital flows and policy direction to sectoral realignments and market opportunities.

Through focused discussions and curated sessions, the summit will explore how public markets, private capital and emerging sectors are adapting to new global realities, shaping India’s economic trajectory over the next decade.

Day 1 - March 11th, 1 PM Onwards

DAY ONE

11-March-2026

1:00 - 2:00 PM

Registration & Networking Lunch

2:00- 2:05 PM

Welcome from Mint

2:05 PM – 2:15 PM

Welcome Address

2:20 PM – 2:50 PM

Opening Keynote: The promise that India holds

2:55 PM – 3:40 PM

Fireside Chat

3:45 PM – 4:15 PM

Fireside Chat: Global Investors' Interest in India's Real Assets

4:20 PM – 4:50 PM

Tea Break

4:55 PM – 5:25 PM

Panel Discussion: The Lure of the Public Markets

5:30 PM – 6:30 PM

Closing Keynote: Global capital perspectives

6:30 PM – Onwards

Cocktails & high tea

DAY TWO

12-March-2026

10:00 AM – 11:00 AM

Registration & snacks

11:00 AM – 11:15 AM

Welcome from Mint

11:15 AM – 11:55 AM

Fireside Chat: Next-Gen Business Builders

12:00 PM – 12:40 PM

Panel Discussion: Value Creation Through Bolt-Ons

12:45 PM – 1:30 PM

Panel Discussion: Founders Turning Investors

1:30 PM – 2:30 PM

Lunch Break

2:30 PM – 2:55 PM

Fireside Chat: Are the Animal Spirits Back?

3:00 PM – 3:40 PM

Panel Discussion: Fund Raising in a Post-Tariff World

3:45 PM – 4:25 PM

Panel Discussion: Back to the Basics: Manufacturing Resurgence

4:30 PM – 5:00 PM

Tea break

5:00 PM – 5:40 PM

Fireside Chat: Seed to IPO: Taking Companies Public

5:45 PM – 6:00 PM

Panel Discussion: Does India's Investment Ecosystem Stand to Gain from the Shifting Sands?

6:00 PM – Onwards

Cocktails & high-tea

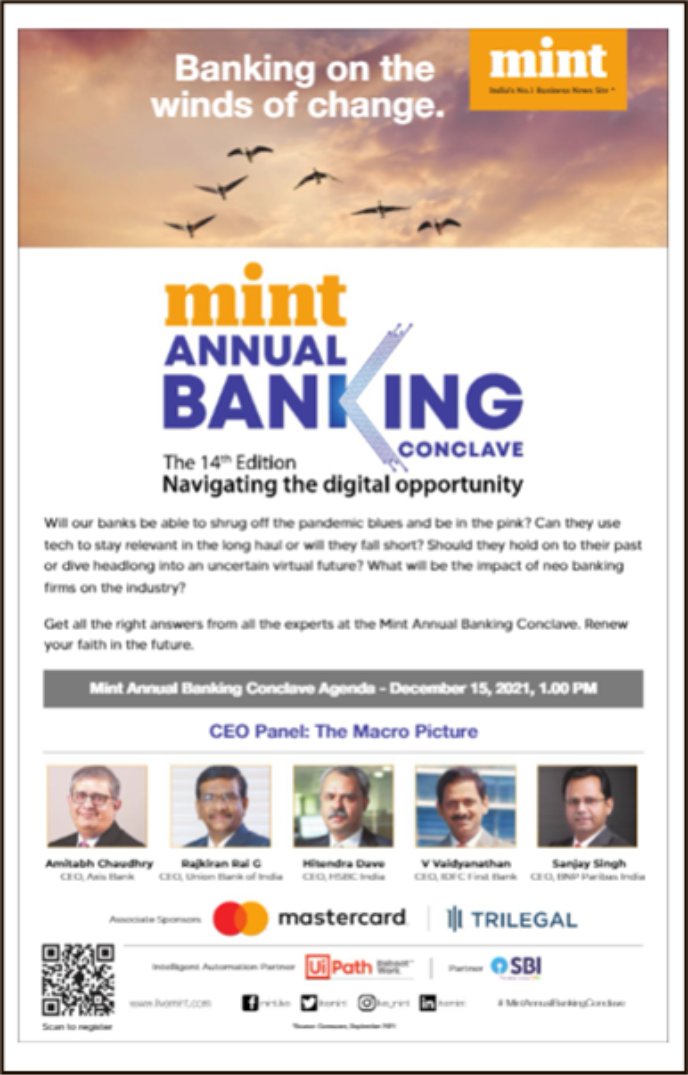

Past Speakers

Vishesh Shrivastav

MD, Temasek Holdings Advisors India Pvt. Ltd

Saugata Gupta

MD & CEO, Marico

Hitendra Dave

CEO, HSBC India

Saurabh Mukherjea

Founder & Chief Investment Officer, Marcellus Investment Managers

Shilpa Shetty

Entrepreneur & Actor,

Yogesh Mahansaria

MD, Mahansaria Tyres

Nruthya Madappa

Partner, 3one4 Capital

Lal Chand Bisu

Co-Founder & CEO, Kuku FM

Rajiv Dhar

MD, National Investment and Infrastructure Fund

Devina Mehra

Chairperson and MD, First Global

Nishant Sharma

Managing Partner, Kedaara Capital

Anand Lunia

Founding Partner, India Quotient

Aakrit Vaish

Co-founder & CEO, Haptik

Subhrajit Roy

MD, Head-Global Capital Markets, BofA Securities India Ltd.

Bhavesh Shah

MD, Equirus Capital

Ashish Kotecha

Partner, Bain Capital

Ashish Aggarwal

BPEA -EQT Partners,

Chirag Agrawal

Leader - Corporate Finance Advisory, Financial Advisory, Deloitte India

Deepak Dara

Senior MD and Head of India, OTPP

Nithya Easwaran

MD, Multiples Alternate Asset Management

Rajesh Jejurikar

CEO, Mahindra Auto

Bharat Puri

MD, Pidilite Industries

Ankit Mehta

CEO, IdeaForge Technology Ltd.

Vijay Gokhale

Our Partners Over the Years

Amplifying Brand Visibility Across Mint’s Media Platforms

Partnering with Mint enables brands to tap into a powerful, trusted media ecosystem spanning print, digital and social platforms. Through integrated pre- and post-event coverage, partners gain sustained visibility and engagement with Mint’s highly influential and premium audience.

-

30 Mn+

Reach Across Mint & HT assets

-

650K

Reach through print news

-

72%

Exclusive readers for Mint

-

51%

From NCCS A1 Premium Readership Profile