Targeted Digital Campaign

How a leading BFSI brand in India achieved 2.5x improvement in campaign CTR in a hyper-targeted campaign using HT One Audience – HT Media’s CDP

Category: BFSI

Client Brand: A leading BFSI company in India

Solution: Targeted Digital Display Ads

Background of the BFSI Industry in India

The BFSI industry in India encompasses a diverse range of retail loan products, including home loans, personal loans, and vehicle loans, offered by banks and financial institutions. With a growing economy and increasing consumer demand, the sector plays a crucial role in providing financial services to a vast and dynamic market.

The Brand Ask

Background

An India-based leading retail BFSI brand had launched new loan categories like home loans, two and four-wheeler loans, as well as personal loans and business loans. The brand wanted to take these products to the market digitally to its target group.

Client Objective

With the launch of new loan products, the brand’s campaign objective was to build brand salience, increase awareness of their flexi plus loans, reach potential target audience to increase its brand and product awareness and impact the conversion stage of the funnel.

Our Approach

The BFSI brand collaborated with HT Media for their targeted digital campaign. The campaign was conceptualised with the objective of building brand salience amongst potential customers through digital display ads. The HT One Audience team identified the most relevant audience cohorts for the client brand. All HT One Audience cohorts are Nielson-verified. Using campaign optimisation at placement, creative and device levels, the HT One Audience delivered targeted digital displays in variations of placement and creatives for maximising impact across the marketing funnel.

Results

- The audience strategy team at HT Digital suggested turning the campaign into multiple hyper-targeted campaigns with creatives that conveyed features of a loan product to specific audience cohorts.

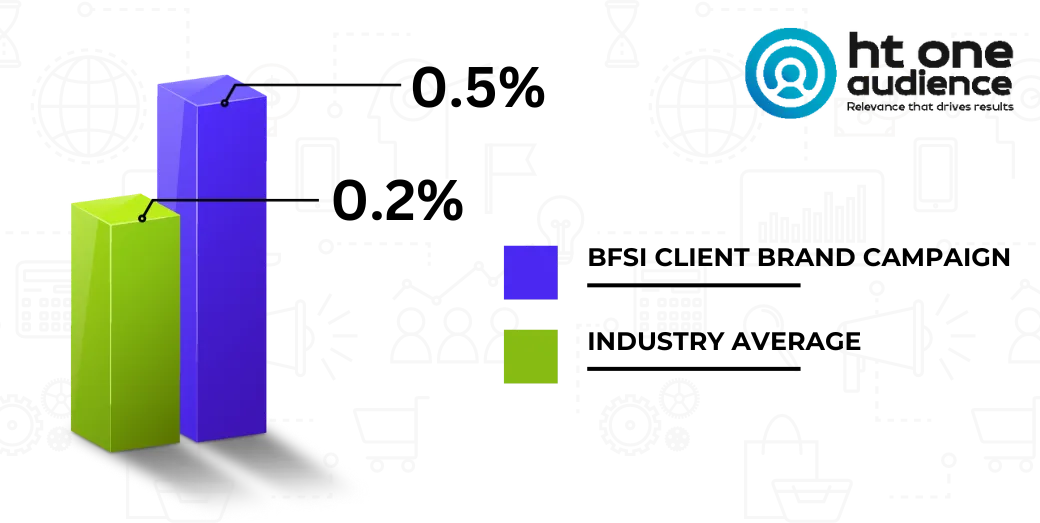

- The right mix of platforms, audience, creatives and messaging resulted in a phenomenal 2.5X increase in CTR vs. the industry average.

- Through the campaign, the BFSI brand was able to reach, engage, and inspire customers with highly relevant messages.

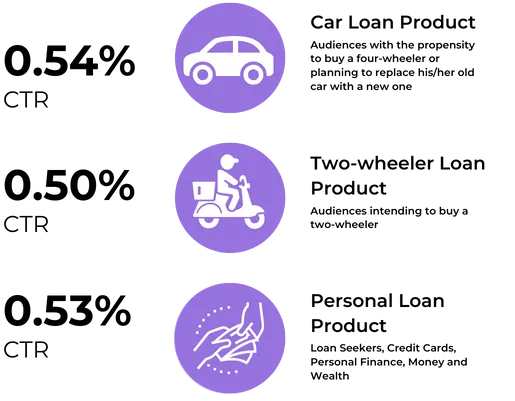

- As a result, the campaign received 0.48% CTR on home loan product, 0.81% CTR on business loan product, 0.54% CTR on car loan product, 0.50% CTR on two-wheeler loan product and 0.53% CTR on personal loan product.

Impact Highlights

Insights & Key Takeaways

Placement Level Campaign Optimisation

Placement Level Campaign Optimisation

To make the most impact, the ads were optimised by experimenting and testing with placements at different sections / levels of the webpage.

Creative Level Campaign Optimisation

Creative Level Campaign Optimisation

Several creative variations were tested on the target audience. Gif creatives outperformed static creatives.

Device Level Campaign Optimisation

Device Level Campaign Optimisation

The ads were designed to generate the best response possible across mobile and desktop devices.

Insights & Key Takeaways

Placement Level Campaign Optimisation

Placement Level Campaign Optimisation

To make the most impact, the ads were optimised by experimenting and testing with placements at different sections / levels of the webpage.

Creative Level Campaign Optimisation

Creative Level Campaign Optimisation

Several creative variations were tested on the target audience. Gif creatives outperformed static creatives.

Device Level Campaign Optimisation

Device Level Campaign Optimisation

The ads were designed to generate the best response possible across mobile and desktop devices.