Initial Impact on Insurance Providers

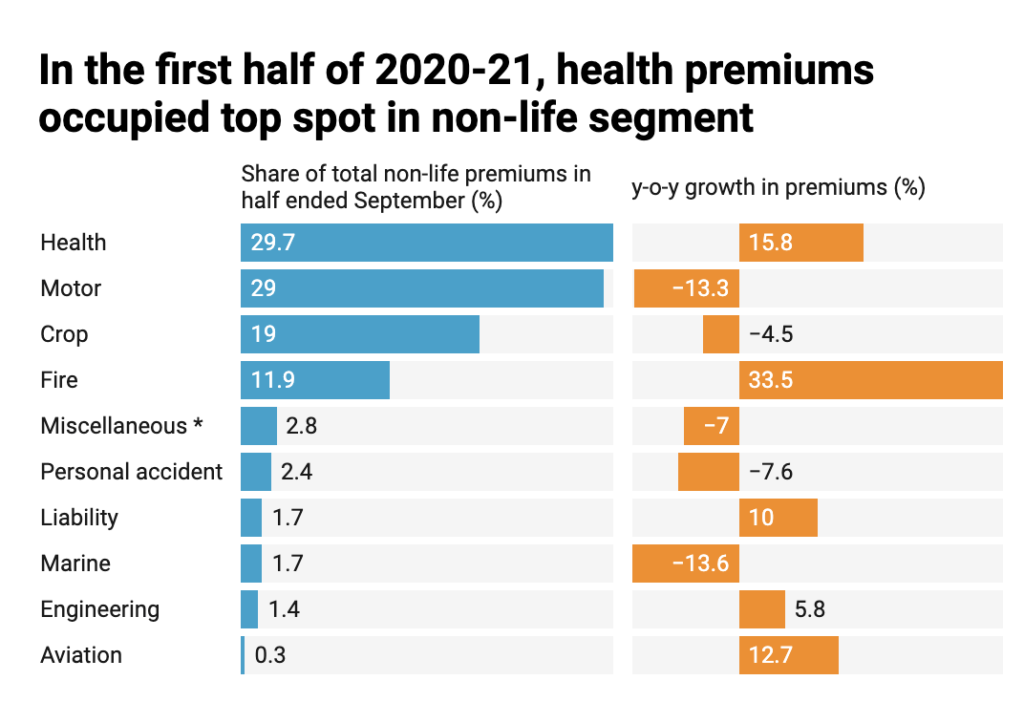

For the first time since the insurance industry was thrown open to private players around 20 years ago, the COVID-19 pandemic caused health insurance to become the most valuable segment for insurers in terms of premiums collected.

The General Insurance Council revealed that during the first half of 2020 (April to September), health insurance accounted for 29.7% of premiums collected, up from 23.4% in 2014-15. We can attribute this strong uptick to swift and aggressive steps taken by insurance companies like yours to meet the changing demands and consumer behaviour.

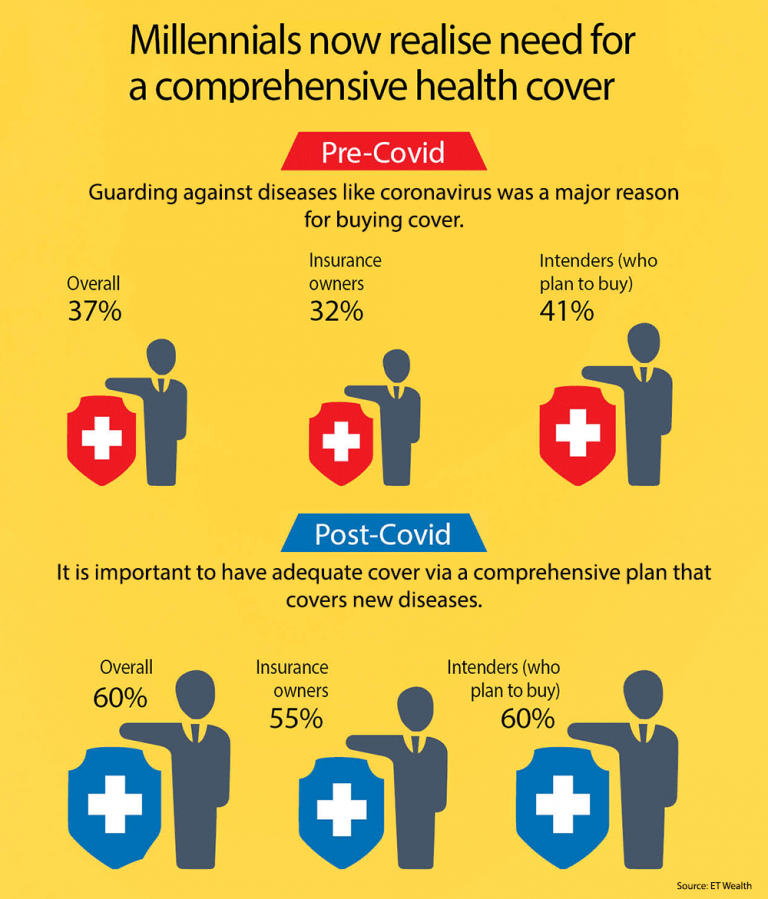

Because of the pandemic, consumer awareness has spiked significantly, with many (including millennials) now realizing that insurance is a necessary safeguard against the unpredictable circumstances of this deadly illness.

In fact, before the outbreak in India, a mere 10% of people showed interest in buying insurance to cover medical emergencies, sharply contrasting with 71% of people who consider it a necessity now.

Ongoing Impact of the Second Wave

Despite this positive start, the outlook has turned grim just one year later. The additional strain of premium revisions and medical inflation because of the second wave of the pandemic is not sustainable for the industry.

Much to the dismay of consumers, both private and state-run insurers have been delaying payments. According to data from the General Insurance Council as of March 31st 2021, only 54% of the claims received from customers have been settled. Out of the 9,96,804 claims made for COVID-19, insurance companies have only settled the claims of 8,55,250 people.

Strategic Realignment: 4 Ways Insurers have Adapted

To weather this crisis, insurance companies must continue to optimize costs, automate and modernize as a part of their fight to handle claims, sustain business and inflate the value for shareholders and policyholders alike. The once-in-a-lifetime experience of handling thousands of claims last year should equip insurers with the resilience required to tide over the second wave, and beyond.

Keeping customer centricity as the linchpin, here are some strategies that insurance companies like yours should adapt to emerge triumphant when the pandemic situation improves:

1) Product innovation

Traditionally, insurance policies have functioned as a legacy industry catering to a homogenous population and showing limited innovation. But in the current scenario, these outdated products have failed to address individual risk exposures and other associated risks that have become pervasive.

Forward-thinking insurance companies have offered innovative schemes like differentiated policies, comprehensive digital health policies, and better customer data tracking to move ahead in the race.

2) Digital transformation across the value chain

Another factor holding the industry back is the slow transition to a digital-driven services environment. Luckily, the COVID-19 pandemic has sped up this transition, forcing companies to think of innovative ways to digitize their value chains.

Companies that have invested in self-service portals, new-age solutions like Artificial Intelligence, Machine Learning, cloud telephony, blockchain are already better poised to take customer experience to the next level and optimize costs.

For example, IndiaFirst Life Insurance has enabled an end-to-end paperless onboarding process for new customers in the time of social distancing and contactless transactions.

3) Reskilling staff

Gone are the days of the face-to-face physical model. Insurers can no longer interact with potential customers to close deals. That’s why there’s a rising need to retrain your staff on how to engage with customers, navigate queries and close sales in a 100% digital environment.

This rise in new tech-driven roles within companies has led to a “digital skill gap”. The urgent need of the hour should be to bridge that as quickly as possible.

For example, teaching your analytical teams to incorporate novel and unconventional sources of data into their assessments will aid them to produce better risk models and improved predictive power.

4) Value-added services

Now more than ever, insurers should focus on showing empathy for customers by going above and beyond regular commitments. Offering complementary and value-added services will set you apart from other companies.

These could include “need-of-the-hour” products like hospital tie-ups, online doctor consultations, pharmacy discounts, telehealth services and more.

By including these complementary services, you’ll be providing a more holistic and useful solution to new and existing customers, which will enable opportunities for greater market reach and customer retention.

Going Forward

For now, the priority for insurance providers like you should be to reach out proactively to customers and increase awareness of the many ways that they can contribute to curbing the spread of the disease through informative digital advertising campaigns.

At a time when empathy can be an essential brand differentiator, it’s also crucial to remind your potential customers that you’re there to help them and their loved ones with affordable claims packages. And to deliver that message directly to them in a cost-effective manner, we’d recommend that you look to maximize the reach of your message through Print, Radio and Digital–all channels for amplified impact.

So, if you need a convenient platform that helps you advertise your message across these channels, visit HT AdWorks– HT Media’s flagship program that offers customizable media plans, expert consultations and exclusive discounts.

Ready to take your brand to the next level? Connect with us today to explore how HT Media can amplify your presence across our diverse portfolio of 25+ brands and properties. Let's turn your brand vision into reality!

Comment